Dubai Office Real Estate Market in H1 2025

The Dubai office real estate market in H1 2025 demonstrated record results, further consolidating the city’s status as one of the world’s leading business hubs.

This article provides a detailed analysis of key trends, statistics and forecasts.

In the first half of 2025, Dubai’s office real estate market showed significant growth across all major indicators:

• The number of office property sale transactions reached 1,900 (+22% compared to H1 2024)

• Total sales value amounted to AED 5.4 billion (+84% year-on-year)

• Rental rates increased by 26% compared to the same period in 2024

• Vacancy in prime districts dropped to 0.2%, indicating extremely high demand

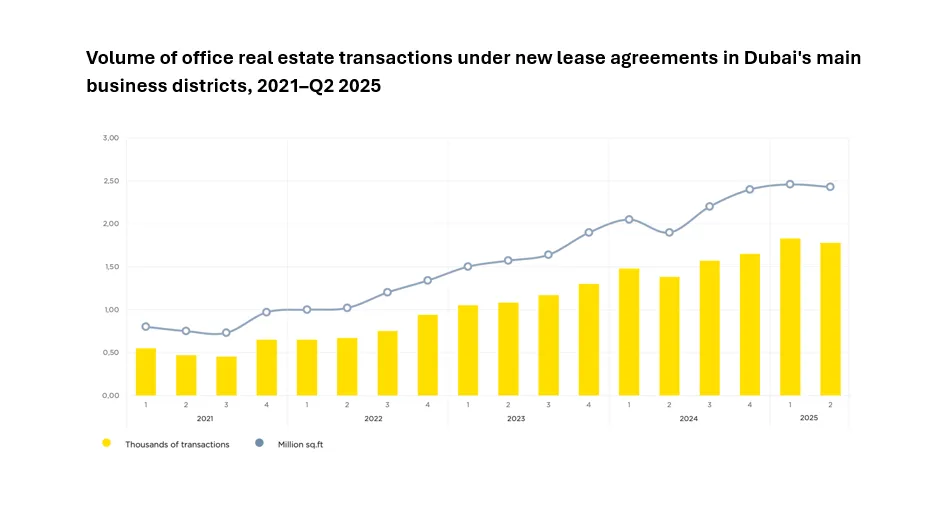

Volume of office real estate transactions under new lease agreements in Dubai's main business districts, 2021–Q2 2025

Dubai continues to attract international companies due to its favorable tax regime, modern infrastructure, and stable economic policy. For the first time in years, interest has increased not only in traditional business centers but also in emerging areas such as Dubai South and Expo City.

To find an office to buy or rent in the UAE and Oman, please submit your request

Leave a request

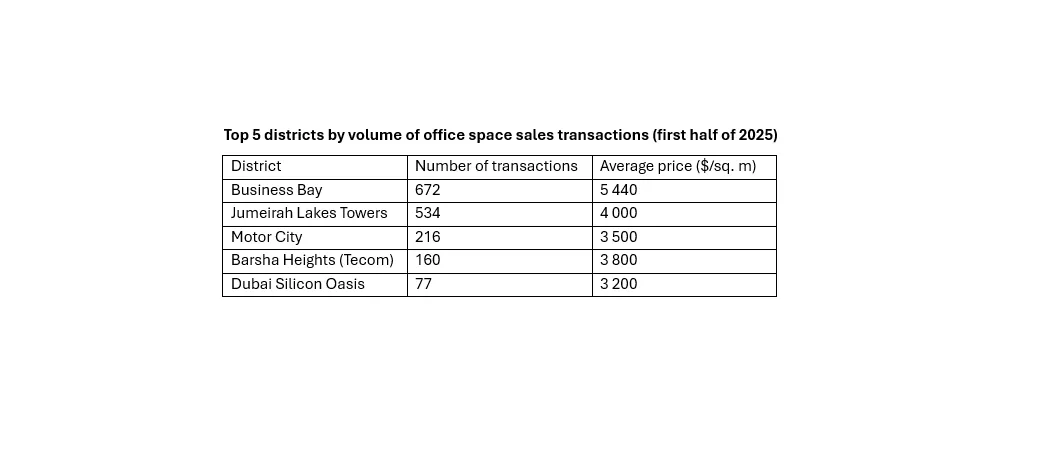

Analysis of office space sales in Dubai

Key indicators and trends in office real estate sales

• 1,900 office transactions completed with a total value of AED 5.4 billion

• Average sales price reached $6,000/sq.m (+30% compared to H1 2024)

• 80% of transactions were for completed properties, 20% for under-construction projects

• Sales volume in the under-construction segment grew tenfold, driven by new project launches in late 2024 – early 2025

To find an office to buy or rent in the UAE and Oman, please submit your request

Leave a request

Dynamics of office space sales prices in Dubai

Key indicators and trends in office real estate sales

• 1,900 office transactions completed with a total value of AED 5.4 billion

• Average sales price reached $6,000/sq.m (+30% compared to H1 2024)

• 80% of transactions were for completed properties, 20% for under-construction projects

• Sales volume in the under-construction segment grew tenfold, driven by new project launches in late 2024 – early 2025

To find an office to buy or rent in the UAE and Oman, please submit your request

Leave a request

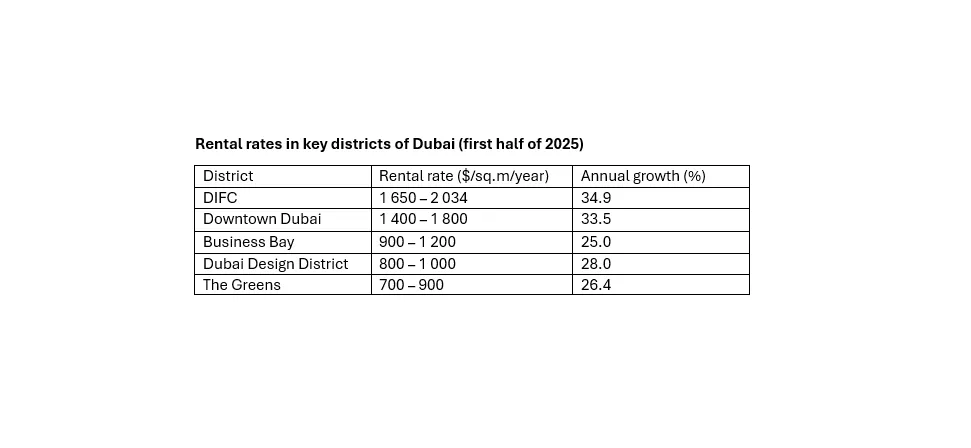

Analysis of the office rental market in Dubai

Key indicators and trends in office property rentals

• Average rental rate citywide: $600 sq.m/year (203 AED/sq.ft/year), up 15% from H1 2024

• In prime segments (e.g., DIFC and Downtown), rates reached $2,000 sq.m/year (700 AED/sq.ft/year)

• 3,600 new lease agreements were signed

• Аverage leased unit size: 135 sq.m

• Rising popularity of hybrid spaces combining office and recreational zones

• Companies consolidating space in modern ESG-compliant buildings

Dynamics of rental rates in different areas of Dubai

• DIFC remained the most expensive area with rents up to $1,650 sq.m/year

• Downtown Dubai and Business Bay recorded 25% rent growth due to limited supply and high demand from financial and technology companies

• The Greens (+26.4%), Dubai Design District (+28%), and Barsha Heights (Tecom) also showed significant increases

To find an office to buy or rent in the UAE and Oman, please submit your request

Leave a request

Investment and business activity in Dubai

Dubai reaffirmed its role as a global investment hub

• 526 greenfield FDI projects attracted, valued at $3.03 billion (86% of UAE total)

• DIFC registered 1,081 new companies (+32% year-on-year), raising the total to 7,700 active companies

Key business sectors in Dubai – drivers of demand

• Business services (38%)

• Technology (31%)

• Real estate (12%)

• Banking and finance (10%)

Investors show interest in under-construction office projects thanks to flexible payment plans and lower entry prices.

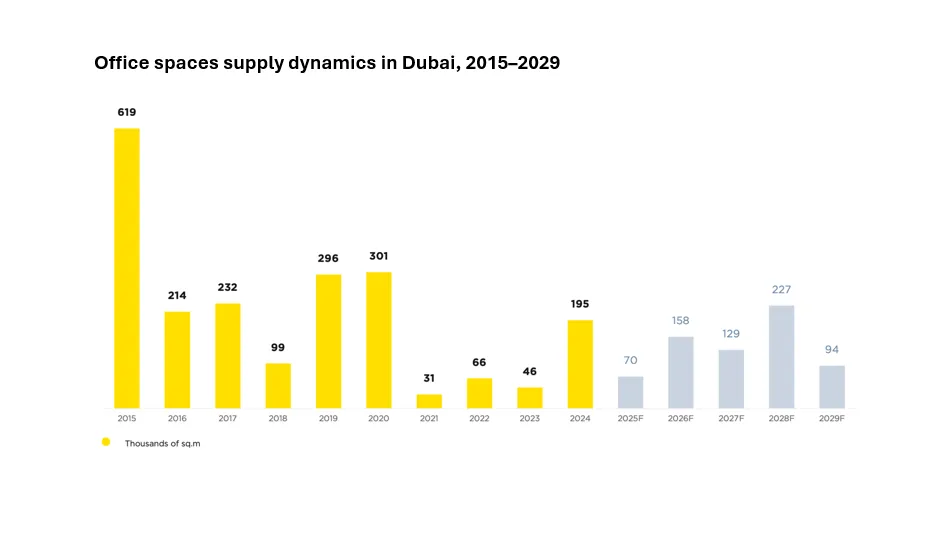

Office space supply in Dubai

• Total office stock in Dubai: 9.32 million sq.m

• 34,000 sq.m delivered in H1 2025; an additional 110,000 sq.m scheduled by year-end

• 700,000 sq.m of new office space expected by 2029

To find an office to buy or rent in the UAE and Oman, please submit your request

Leave a request

Office spaces supply dynamics in Dubai, 2015–2029

Development of districts in Dubai: influencing factors and trends

• Dubai South: development tied to Al Maktoum International Airport construction – set to be the world’s largest

• Expo City: transforming into a multifunctional business hub with a focus on innovation and sustainability

• Metro Blue Line (opening 2029): will improve connectivity to eastern districts

• Concentration of new projects in DIFC and Business Bay: 7 million sq.ft to be added in DIFC by 2030, 1.3 million sq.ft in Business Bay

Forecasts for the cost and demand for office space in Dubai for 2026

• Rental rates and sales prices will continue rising in the near term due to limited supply and strong demand. However, starting 2026, new supply may ease market pressure

• The gap between prime and secondary districts will widen. Prices in DIFC and Downtown Dubai will grow faster than in older areas such as Bur Dubai and Deira

• Rising popularity of emerging districts: Dubai South, Expo City, and Jumeirah Village Circle (JVC) will attract investors with affordable prices and growth potential

• Despite the exceptional dynamics of Dubai's office property market, the market is expected to see a correction of ~10% next year, which is likely to be a temporary “healthy pause” rather than a crisis.

Key recommendations for investors and tenants

1. Carefully evaluate developer reputation when buying under-construction properties

2. Focus on premium assets in strategic locations (DIFC, Downtown, Business Bay) for capital protection

3. Consider emerging districts (Dubai South, JVC) for higher returns

4. Account for long-term trends such as digitalization, sustainability, and space consolidation

5. Dubai remains one of the world’s most attractive office real estate markets, offering investors unique opportunities for growth and portfolio diversification.

To find an office to buy or rent in the UAE and Oman, please submit your request

Leave a request

consultation

Our services

- Investment

- Immigration

- Purchase of property